PLAY:double click STOP:one click Before any journey, we try to understand the trail in order to leave the starting point and reach where we want to be. Important as it is to know the way, it is also important to know ourselves, to identify our values, to know whom we can count on and to be clear on what to expect from those who walk with us. COPASA invests, with ethics and transparency, in relationships that make of their roads, good and safe paths to walk on.

CORPORATE GOVERNANCE STRUCTURE COPASA is a mixed capital company and publicly-held, with shares negotiated in the Novo Mercado [New Market], maximum segment of corporate governance of Bolsa de Valores, Mercadorias e Futuros S.A. (BM&FBOVESPA) (Securities, Commodities & Futures Stock Exchange), having the State of Minas Gerais as the controlling shareholder. In September 2003, now a public company, the corporate governance structure of COPASAsuffered a significant development. Since then, the Company has been seeking the improvement of its corporate governance practices through transparency, fairness, accountability and corporate responsibility in the relation with its interested parties. COPASA’s commitment with the corporate governance best practices is evident by its adhesion to the highest level of BM&FBOVESPA’s corporate governance – Novo Mercado - still in the Initial Public Offering(IPO) realized in February 2006, in order to guarantee the balance of interests among the shareholders and to expand its rights, in relation to the current legislation. Among the governance good practices with which COPASA is committed, the following are highlighted:

(GRI 2.3) COPASA organizational structure which is based in the clear definition of the responsibilities of each body consists as follows:

Organization Chart current on December 31st, 2011.

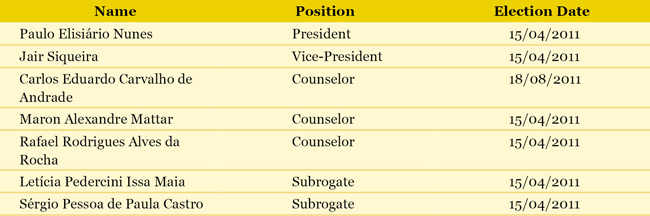

General Meeting of the Shareholders In 2011, one General Ordinary Meeting and six General Extraordinary Meetings were held. Audit Board In 2011, 13 Audit Board meetings were held, of which 12 were ordinary and one was extraordinary. Composition of the Audit Board on December 31st, 2011:

The CVs of the Members of the Audit Board can be accessed at www.copasa.com.br/ri, Corporate Governance section Of these members, Mr. Rafael Rodrigues and his subrogate Ms. Letícia Pedercini Issa Maia were elected representatives of the minorities. (GRI 4.3)

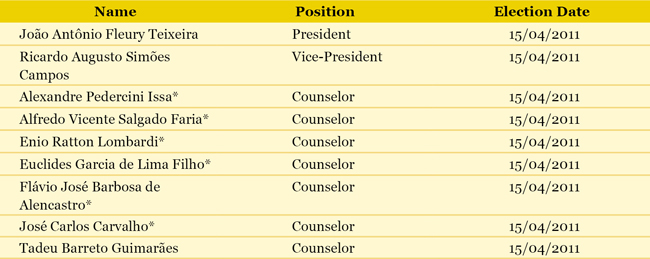

The Board of Directors is the highest collegiate decision-making body of collegiate of COPASA. Among others, its attributions are: the summons of General Meetings; approval of the strategic planning; approval of the business plans and annual budgets, and the multiannual, operational and investment plans of the Company; election and dismissal of directors and designation of the responsibilities; approval of new concessions which Present Net Value (PNV) is negative, according to economic-financial viability study realized by the Company; approval of career and salary plan, and investments or expenses not prescribed in the annual budget of values from R$6 and R$150 million; choice and dismissal of independent auditors. (GRI 4.7) The Board may consist of a minimum of five and a maximum of nine members, including the president and the vice-president, elected by a General Meeting of Shareholders. The choice of the counselors takes into consideration qualifications, knowledge in relation to COPASA business and lack of conflicts of interest. The Board’s members fulfill a one year unified mandate, except for dismissal, taking into consideration that this exercise mandate consists of the period included between every General Ordinary Meeting, and with the possibility of being reelected. The compensation of each counselor corresponds to 20% of the average compensation paid to the members of the Executive Board, considering that 50% of the value is equivalent to a fixed monthly installment and the other 50% are paid according to the participation of the counselor in the monthly meetings. Furthermore, the counselors receive 20% of the Profit Participation (PP) attributed to the directors. (GRI 4.5) As for the frequency of the meetings, the Board of Directors realizes one meeting per month as ordinary and extraordinarily whenever necessary. According to the Internal Rules of the Board of Directors, its member must declare, before the decision-making, whenever the matter submitted for appreciation has a particular or conflicting interest with the company’s interest, thus avoiding participating of its discussion and of its voting. (GRI 4.6) In 2011, the Board of Directors met 14 times. (GRI 4.2) In the present composition, only the vice-president of the Board is part of COPASA’sExecutive Board. The Board of Directors members elected in April 2011 and whose mandate will end in the General Ordinary Meeting of 2012 are the following: Composition of the Board of Directors on December 31st, 2011

* Independent Counselors.(GRI 4.3) The CVs of the Members of the Board of Directors can be accessed at www.copasa.com.br/ri,Corporate Governance section.

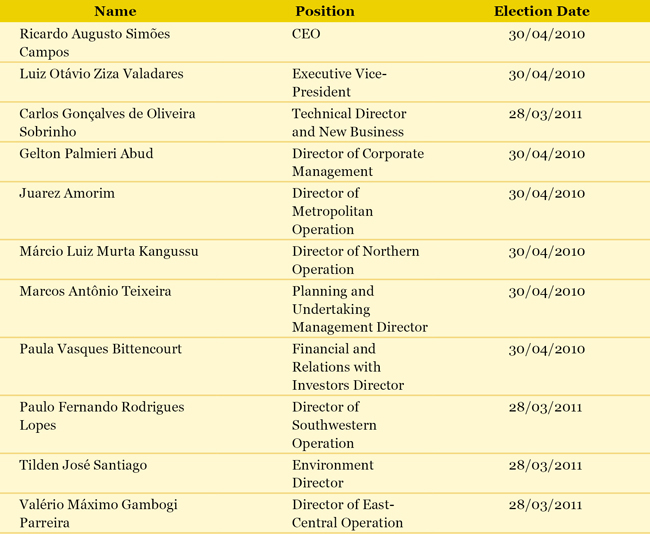

Executive Board The Executive Board is responsible for the administration of COPASA business in general. It ordinarily meets at least once a week and extraordinarily whenever the social business requires. To consolidate the alignment of the strategies and guidelines of the Company, according to its strategic planning as well as to provide the follow-up of relevant issues for the Company’s performance, periodic meetings of the Executive Board are held with the management team. The Executive Board consists of up to 11 members, shareholders or not, resident in the country, elected by the Board of Directors for a three years mandate, with the possibility of being reelected and having to keep their positions until the election and investiture of their successors. The directors have individual responsibilities established by the Board of Directors and by the Company’s bylaws; besides the fixed fees, they receive a variable remuneration in the form of Profit Participation (PP), as approved by the Board of Directors. The Executive Board is composed by the President, Vice-President and nine directors: four operational directors (Director of East-Central Operation, Metropolitan, North and Southwest) and five corporate directors (Financial and Relations with Investors, Corporate Management, Planning and Undertakings Management, Environment Management and Technical and New Businesses Management). In 2011, 50 meetings of the Executive Board were held and 903 Resolution Releases of the Board. Composition of the Executive Board on December 31st, 2011

The CVs of the Members of the Executive Board can be accessed at www.copasa.com.br/ri, Corporate Governance section. Internal Audit The Internal Audit department, linked to the Presidency of the Company since 1975, as of 2007, reports directly to the Board of Directors, having therefore independence and impartiality to exercise its functions, which are: planning and execution of audit works in all of the control systems; identification of failures and/or irregularities; proposals for improvements; recommendation and follow-up of actions implementation. The Internal Audit is also responsible for the generation, as a product of the functions mentioned above, of useful and reliable information to guide and support COPASAExecutive Management’s and Board of Directors’ decisions. In 2011, of COPASA 150 units (divisions and districts), 34 were submitted to internal audit, in aspects related to the assessment risk of the process, including the identification of eventual cases of corruption, resulting in a total of 22.67% of the Company. As of this work, 84 recommendations were issued to the audited units. (GRI SO2) Of the nine reports of irregularities investigated by the Internal Audit in 2011, six were upheld. Regarding the independent audit, for the observance of CVM Instruction No. 381, the company that rendered the audit services of COPASA financial demonstrations for the year ended on December 31st, 2011, was Ernst & Young Terco Auditores Independentes S/S. The contract signed with this company contemplates the audit services of the financial demonstrations since 2008. Ernst & Young Terco Auditores Independentes S/S did not render any other service to COPASA during this same period of time.

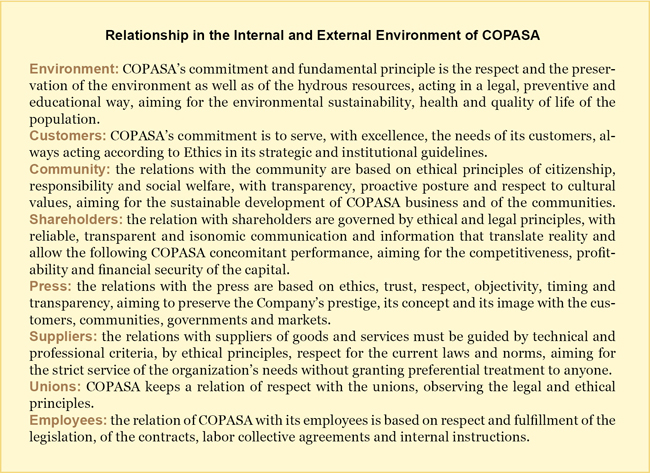

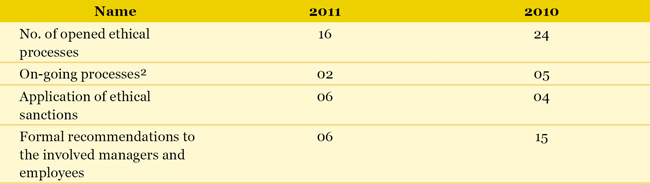

CODE OF ETHICAL CONDUCT In 2005, COPASA established its Code of Ethical Conduct which seeks to systemize the ethical guidelines that lead the Company’s performance. The Code of Ethical Conduct is a public document and involves all COPASA employees and trainees, service renderers and those who have a mandate to fulfill, even if transitory and without remuneration, by election, appointment, designation, contracted or any other manner of link or investiture. Furthermore, this Code establishes guidelines for COPASA’s relationships, as it is demonstrated in the following table: Excelling in the fulfillment of the guidelines established in the Code and in order to guarantee the development of ethical culture, COPASA counts with an Ethics Commission composed by six members. The Commission guides and instructs the employees on issues related to the interpretation and application of the Code of Ethical Conduct, holding periodical lectures, according to the program of the organizational units, besides being responsible to assess and decide on any violation and breach of the Code. The Commission also receives and examines reports and facts, makes decisions in their respects and suggests measures and procedures for the Company’s administration decision. Ethic Processes¹

¹ situation on December 31, 2011. The Ethics Commission holds weekly ordinary meetings. In 2011, 46 meetings were held and 12 lectures were administered with the objective of disseminating the guidelines of the Code of Ethical Conduct to 471 employees. (GRI SO3)

RELATIONSHIP WITH INVESTORS

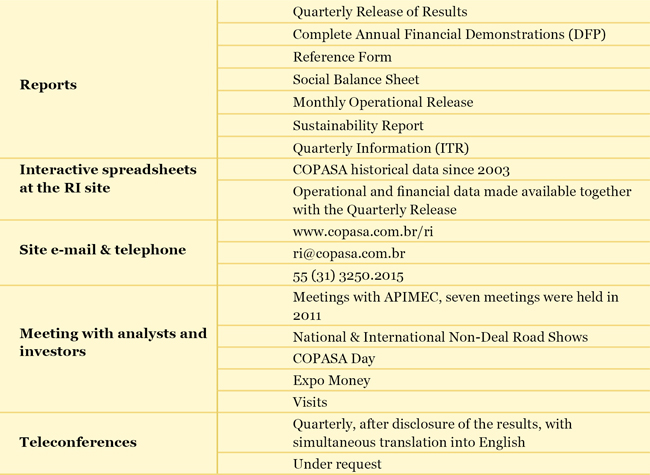

COPASA adopts as its Relation Policy with Investors (PI) the transparency, the timing and the quality in the rendered seeking this way to provide subsidies sufficient for a decision-making regarding investment in the Company’s shares, reducing the asymmetry of information. This is why the Company discloses to the investors through reports, releases, website, etc., information that go beyond what the legislation reguires. COPASA also received, in 2011, a significant number of visits from investors and analysts from the national and international capital markets and participated of conferences, seminars and meetings, and realized a non-deal road show (individual or group meetings with investors) at the main financial centers of Brazil, Europe and North America. Communication tools with investors

As a result of this proactive kind of information with the market, in December 2011 COPASAhad 17 institutions for the preparation of reports with recommendations on the Company. In 2011, the Company was awarded a prize in the 13th edition of the IR Global Rankings – (RGR), an award that classified and identifies the best practices in the area of Relations with Investors. In the South American ranking, COPASAwas considered among the Top 5 of the Financial Disclosure category.

RELATIONSHIP WITH STAKEHOLDERS (GRI 4.16) COPASA relates with its stakeholders according to its values, principles and beliefs, aiming for the alignment of interests and identification of the involved parties’ expectations. Thus, the Company uses interaction forms and relation channels aligned with its management to communicate decisions, mobilize the work force and build partnerships aiming for the sustainable development of its business and of society. COPASA considers as its principal stakeholders or interested parties the following groups: Customers COPASA relates with the users of its services based on quality guidelines and on the Code of Ethical Conduct, with a focus on the constant improvement of the instruments used in the relation with its customers who have available help service for requests, explanation on doubts, records of demands (claims or praises) and ombudsman regarding issues that have not been solved at the instances or by the units directly responsible. (See COPASAand its Customers) The State of Minas Gerais The State of Minas Gerais, with 53.1%* of COPASA shares is the Company’s controller. Operations with related parties are realized at prices and conditions considered by the Administration as compatible with those on the market, except for the form of financial settlement, which may occur by means of special negotiations (rendering of accounts). The Regional Development Department and of Urban Policy of Minas Gerais (Sedru) is the agency to which COPASA institutionally linked to the State Government of Minas Gerais. Furthermore, COPASA observes the decisions of the responsible governmental bodies for matters connected to its performance area, with emphasis on the Regulating Agency of Water and Sanitary Sewage Services of the State of Minas Gerais (Arsae MG) and on the environmental agencies, under the supervision of the Corporate Governance Committee of the State of Minas Gerais. Suppliers and Service Renderers COPASA relation with suppliers and service renderers is based on the current legislation, with emphasis on Law 8666/93 which guides the procedures of selection, contracting and suppliers and service renderers’ management by public agencies and entities. Furthermore, the Company’s relations with suppliers of goods and services are guided by technical and professional criteria, by ethical principles, respect to the current laws and norms, aiming for the strict attendance to the organization’s needs. (See COPASA and its Customers)

Municipalities Internal Public Society and Community

REGULATING AGENCY & MARKET REGULATION The regulation of sanitation public services has the challenge to guarantee the balance between the users’ needs for tariff reasonableness, services of adequate quality and quantity; the needs of the service renderers for economic and financial sustainability and those of investors for adequate remuneration of the investments. The consolidation of the regulatory norm inflicts on the service renderers cost standards and efficiency as well as the definition of operating strategy, expansion forecast of the services and the origin of the resources for the realization of the investments. This way, the establishment of Regulating Agencies is a landmark for the Brazilian sanitation sector as well as for COPASA performance that reinforced the judicious planning of its actions and activities. Federal Law 11445/07 determines that it is a condition of validity of the contracts to have for object the sanitation rendering of public services, “the existence of regulating norms that prescribe the means for the fulfillment of this Law’s guidelines, including the designation of the regulating and inspecting entity”. Following this determination, the State Government of Minas Gerais implemented, in August 2009, Law 18309, which established the norms related to the water supply and sanitary sewage services and created the Regulating Agency of Water Supply and Sanitary Sewage Services of the State of Minas Gerais (Arsae-MG), a special agency linked to the State Bureau of Regional Development and Urban Policy (Sedru). Arsae-MG is responsible to inspect and guide the rendering of public services of water supply and sanitary sewage as well as to issue technical, economic and social norms for regulation. Trying to be prepared for the coping of regulatory issues in a proactive and organized way, COPASA created in 2010 the Superintendence for Regulating Matters of the Services with the objective of assisting the Company’s management in the regulatory issues, coordinating the necessary actions for the attendance of Arsae-MG requirements and to act as interlocutor of the Company. In January 2011, Arsae-MG Normative Resolution 003/2010 entered into force, establishing the general conditions for the rendering and use of sanitation services. From then on, formal work groups were created at COPASA aiming to study adaptation mechanisms of the Company’s internal processes to the new regulation. In March 2011, Arsae-MG opened Public Audience 001/2011 to collect contributions from society, including the concessionaires, on the readjustment methodology of the tariffs regulated by the Agency. Normative Resolution 003/2011, published in March 2011, established the calculation methodology of the Tariff Readjustment Index (IRT) of the sanitation concessionaires regulated by Arsae-MG. Once the economic-regulating framework was defined, Arsae-MG authorized on March 23th, 2011, COPASA tariff readjustment through Normative Resolution 004/2011, and in April 18th, 2011, through Normative Resolution 007/2011, it authorized COPANOR tariff readjustment. These resolutions, which aim to ensure the economic and financial balance of the rendering of the services with attention to the tariff reasonable principle complied with Federal Law 11445/07 and State Law 18309/09. In August 2011, Arsae-MG started the inspection of systems operated by the Company with the objective of verifying the due compliance to Normative Resolution 003/2010. Twelve inspection were made at locations operated by COPASA and produced appropriate report with an assessment of the rendered services and eventual recommendations of adequacy to the regulatory norms. |

||